|

Brent Harris Elliott Wave

Futures Market

Advisory Service

Quarterly Report Sample Page

Cotton (Oct. 10, 2005)

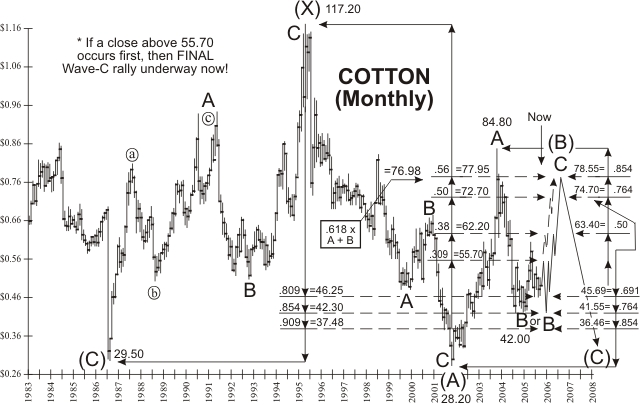

While the long-term pattern in cotton clearly indicates that a

SUPER-CYCLE-WAVE-(C) decline will eventually at least re-test the 2001/(A)-wave

low (28.20), it is virtually impossible (?) to make a case for a completed,

wave-(B) “corrective” rally. Consequently, whether it happens now, OR after one

more moderate-sized decline, a FINAL, wave-C advance to AT LEAST the 76.98-78.55

level should occur, i.e., BEFORE the long-term Bear actually resumes. This key

resistance area yields the 56%-85.4%-retracement combination from the 1995 and

2003 highs, appreciations of 176.4%-and-85.4%-from the 2001 and 2004 lows, as

well as a wave-C advance that is 61.8%-the length of wave-A. Anyhow, given my

slightly preferred, intermediate-term count, the advance from the August low

should hold key resistance at the 55.22-55.70 level. This area incorporates the

30.9%-retracement projections from BOTH the 1995 AND 2003 highs. At which point,

a FINAL, wave-c

decline should re-test the key 76.4%-85.4%-retracement/support combination from

the 1986 and 2001 lows, or 42.30-to-41.55. There is a slight chance, however,

that [wave-(c)] will stretch to the MAXIMUM support cluster, at 37.48-36.46.

This area yields the 90.9%-85.4%-retracement combination, as well as a

56%-depreciation from the 2003 top. Given the ALTERNATE WAVE-COUNT, however,

which will likely be confirmed IF the nearby futures contract closes ABOVE

55.70, we’ll have to figure that the FINAL, wave-C section up is already

underway. In this event, we’ll probably see a

5-wave-pattern-up

develop from the August continuation chart low, with waves-1-and-3-up

probably peaking at the 62.20-63.40 and 72.70-74.70 resistance areas,

respectively. In other words, we should have a good opportunity to go long

(especially) on a pullback from the 62.20-63.40 resistance level, i.e.,

wave-2-of-C.

ORDER BRENT'S QUARTERLY REPORT

|